Tenancy agreement is signed between the landlord and the tenant. If you use property agent service, they might ask you to use their lawyer for the agreement. The professional fees of preparing the agreement may burn a hole in your pocket. It depends on the rental value, the higher the rental value, the higher the professional fees are. However, there’s no law requires a tenancy agreement must be drafted by a lawyer. However, it is advisable engage a lawyer to advise you on the legal implication of certain terms such as preliminary search on the another party, bankruptcy search, land search and etc.

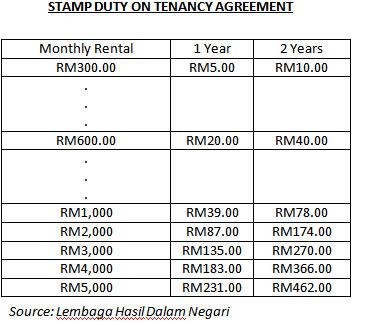

Stamp duty charges depend on the rental value and the tenancy period. For those who want to earn income from rental, it’s important for them to know the procedure of preparing tenancy agreement, to calculate the stamp duty fee for the tenancy agreement. According to Inland Revenue Board Malaysia(IRBM), the following is the stamp duty fee calculation based on the monthly rental amount.

For lease period not exceeding 1 year, it will charge RM1.00 for every RM250 or part thereof in excess of RM2,400 annual rental. In the other words, if your total annual rental is or less than RM2400, you are exempted from stamping fees.

For example, Mr. Lee rent out his condominium with RM1,000 monthly rental to his tenant for lease period of 1 year. His stamp duty calculation for this tenancy agreement will be as follows:

For that tenancy agreement, the annual rental will be RM1000 X 12 = RM 12,000

Total rental chargeable: RM12,000 - RM 2,400 (exempted value) = RM 9,600.

Since the lease period is only for 1 year, the stamp duty rate will be RM1.00 for every RM250 after exceeding RM2,400. Thus, the stamp duty on the original copy of the agreement will be:

RM9,600 / 250 x RM1= RM39 (Always rounded to the nearest Ringgit).

If you have 2 copies of tenancy agreement (original copy for owner, duplicate copy for tenant), the duplicate copy will be charged at RM10, so total is RM49.

No comments:

Post a Comment